Get in touch

555-555-5555

mymail@mailservice.com

This is a subtitle for your new post

When you're in the market for a new home, understanding the ins and outs of down payments is crucial. It's a common misconception that a 20% down payment is a hard and fast rule for purchasing a home. However, the reality is much more flexible, with options varying by mortgage type, financial situation, and more.

Exploring Average Down Payments

The Role of Down Payments

A down payment is your initial investment in your future home. It impacts your mortgage rate, monthly payments, and the need for private mortgage insurance (PMI).

Mortgage Types and Their Requirements

Conventional Loans

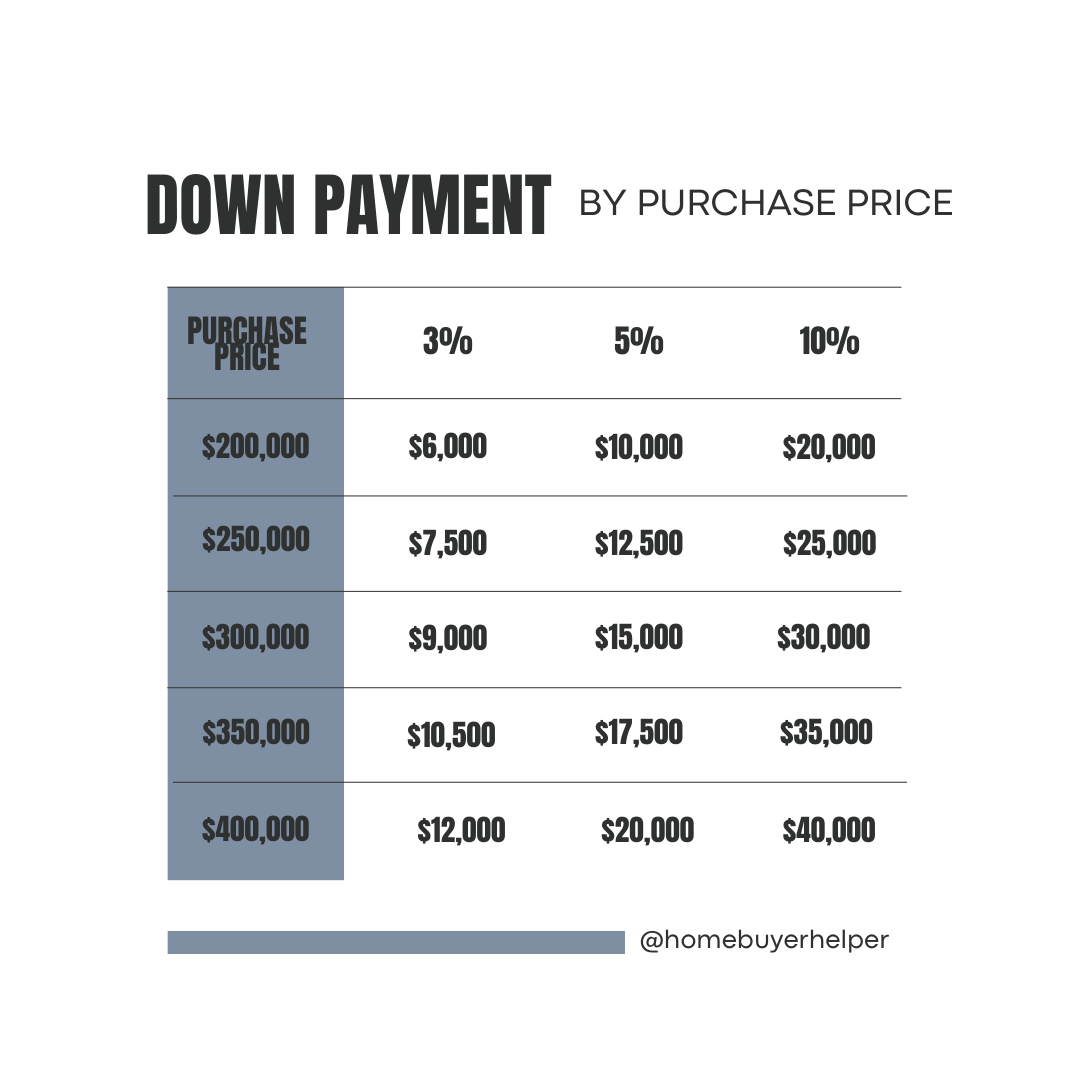

Typically require a down payment ranging from 3% to 20%. A down payment of less than 20% usually necessitates PMI.

FHA Loans

Offered with down payments as low as 3.5% for those with a credit score of 580 or higher, making them an attractive option for first-time homebuyers.

VA Loans

Designed for veterans and active military members, offering the possibility of zero down payment without the requirement for PMI.

USDA Loans

Focus on rural homebuyers, providing the opportunity for no down payment and competitive interest rates.

Jumbo Loans

For homes above conventional loan limits, requiring higher down payments and a strong credit score.

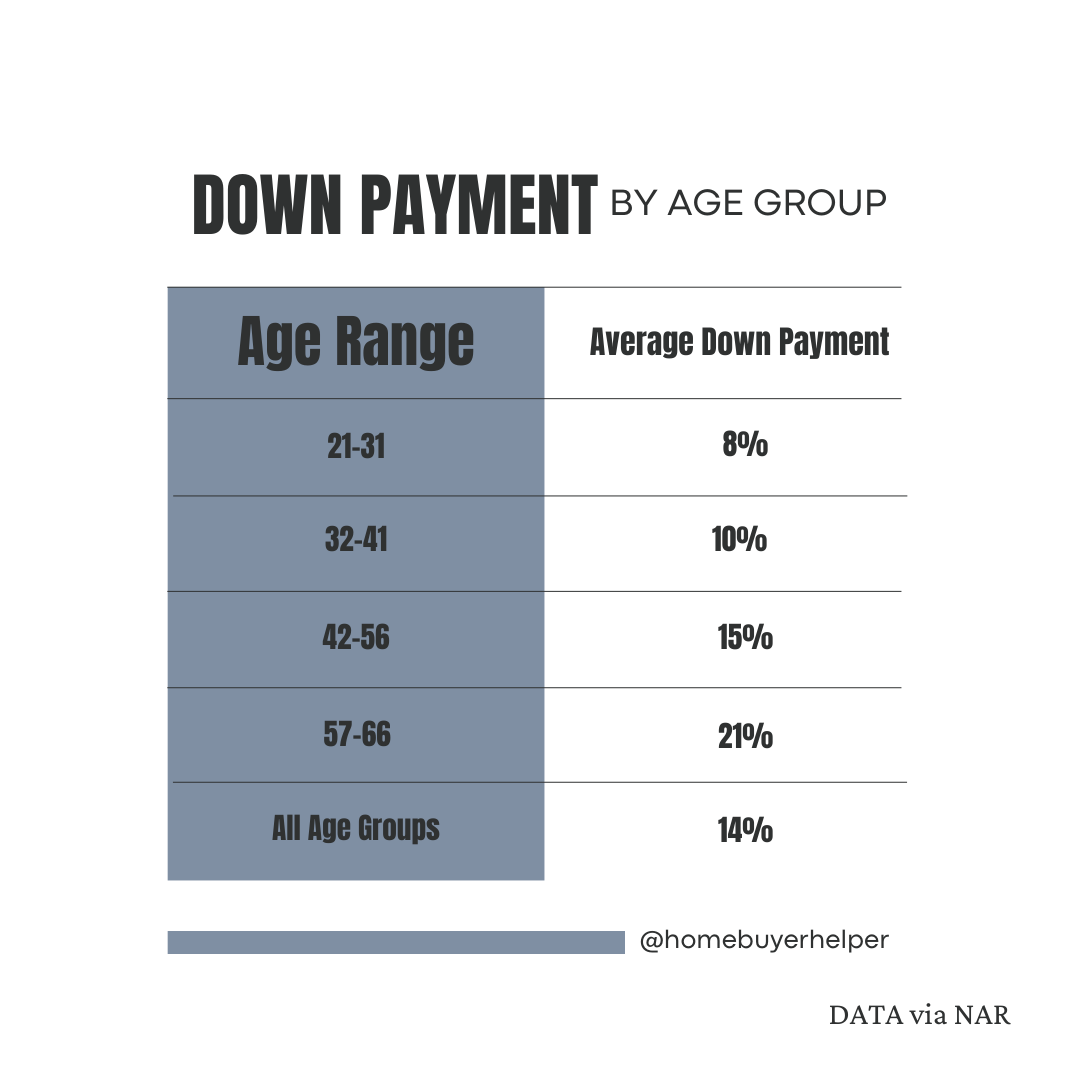

Age and Down Payments

Interestingly, the average down payment varies with the buyer's age, indicating that accumulated wealth and life stage significantly influence purchasing capabilities.

Don't Forget About Closing Costs

In addition to your down payment, closing costs are an essential part of the home-buying equation. These fees cover the processing of your home loan and can include appraisal fees, title insurance, and more. Unlike the down payment, closing costs do not contribute to your equity in the home but are necessary for completing the purchase process.

Conclusion

Buying a house in Spokane, or anywhere for that matter, involves careful consideration of your down payment and closing costs. By understanding the requirements of different mortgage types and considering your financial situation, you can make an informed decision that aligns with your homeownership goals.

© 2024 RCG

For licensing information, go to: www.nmlsconsumeraccess.org | www.goluminate.com | Please review our Disclosures & Licensing information. | Luminate Home Loans, Inc. is a wholly-owned subsidiary of Luminate Bank. Equal Housing Lender. For further information about Luminate Home Loans, Inc., please visit our website at www.goluminate.com. Luminate Home Loans, Inc. NMLS#150953.

Corporate Headquarters: 2523 Wayzata Blvd. S. Suite 200, Minneapolis, MN 55405

Do Not Sell My Personal Information Privacy Policy | Disclosure & Licensing